Who Needs A Trust Instead Of A Will In Virginia?

Thinking about what happens to your stuff after you’re gone?

Yeah, not exactly a fun topic, but it’s super important. Most people default to writing a will and calling it a day. And for a lot of people, that’s totally fine.

But sometimes, a trust is the better way to go especially if you want to make things easier for your loved ones, keep things private, or avoid the whole court process after you pass.

If you’re in Virginia and wondering who needs a Trust instead of a Will, this post is for you.

#1. You Want To Avoid Probate

Probate. It’s one of those words you probably don’t want to deal with.

Probate is the legal process that happens after someone passes away to distribute their assets. It can take months or even years, and the whole thing can be expensive. Plus, it’s a public process, so anyone can look it up.

A trust, however, can help you avoid probate entirely.

When you put your assets into a trust, they aren’t tied up in court. The person you’ve named as a trustee can distribute your assets without waiting for court approval.

This means less time, fewer costs, and a lot less stress for your loved ones. That’s a big win in the world of estate planning.

#2. You Own Property In Multiple States

If you own a vacation cabin in the mountains of North Carolina and a rental condo in Florida, a will alone might trigger something called ancillary probate in each of those states.

Basically, your estate would have to go through separate court processes in every place you own real estate.

Yeah, it’s as annoying as it sounds.

A trust, on the other hand, can help you avoid all of that mess.

By transferring your out-of-state properties into a living trust, you skip those extra probate hoops. Everything gets handled smoothly in one central location.

So if you’ve got real estate across state lines, a trust could save your family a lot of time and headaches.

#3. You Have A Blended Family

Blended families are more common than ever – stepkids, second marriages, half-siblings. It’s a beautiful thing, but it can make estate planning a little complicated.

A trust lets you control exactly who gets what.

Maybe you want your biological kids to inherit certain assets, but also want to leave something for your stepchildren. Or maybe you’re remarried and want to make sure your spouse is taken care of without accidentally disinheriting your kids from your first marriage.

Also Read: Who Needs A Will In Richmond, VA?

You can set all that up in advance with a trust. It’s very difficult to set up with a will.

A trust gives you the flexibility to avoid awkward situations or potential family drama.

#4. You Want Privacy

Wills go through probate, and probate is public. That means anyone (including nosy neighbors and curious coworkers) can look up who inherited what.

Not great if you prefer to keep things private.

So, if you want to keep the details of your estate private, a trust is your best bet.

With a trust, your assets are never part of the public record. No one will be able to see what you owned, how much it was worth, or who got it.

It keeps things out of the spotlight and helps keep your family’s financial matters personal.

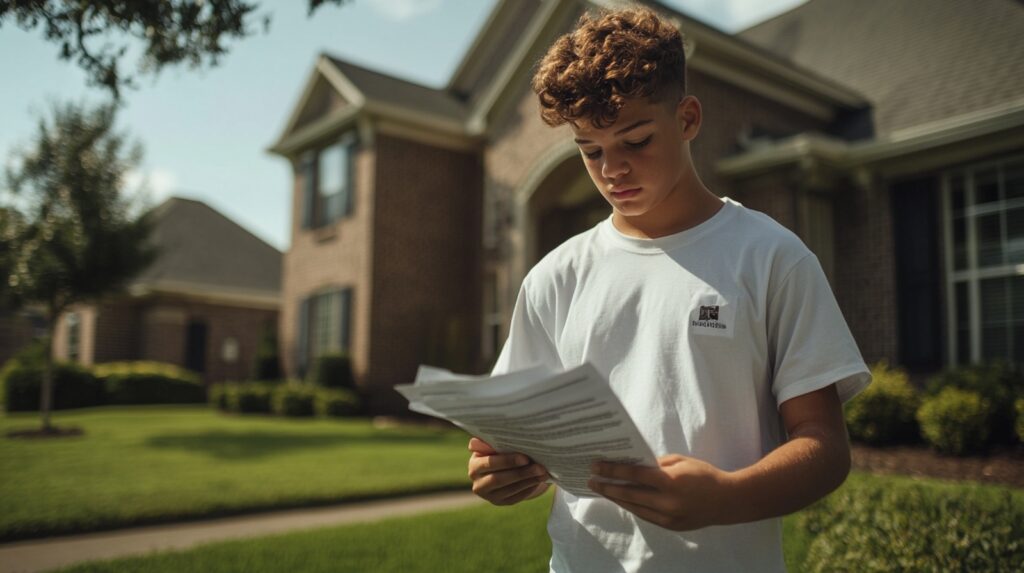

#5. You Want To Protect Minor Children

If you have kids, a trust can be a great way to ensure they’re taken care of the way you want.

A will can appoint a guardian for your young children, but it won’t control how or when your kids get their inheritance. But with a trust, you can:

- Set up funds for your kids’ education, medical needs, or other expenses

- Decide at what age they’ll get access to the money

- Assign a trusted adult to manage everything until they’re ready

It helps make sure your kids are financially supported but not handed a large sum of money before they know how to handle it.

Also Read: How Much Does Estate Planning Cost In Virginia?

#6. You Have A Loved One With Special Needs

When someone you love has special needs, estate planning becomes even more delicate.

A sudden inheritance through a will could unintentionally mess up their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI).

That’s a problem.

A special needs trust can help protect your loved one’s eligibility for these programs.

It allows you to leave money to them without messing up their benefits. Plus, the money in a special needs trust can be used for things that aren’t covered by government programs, like travel, entertainment, or education.

This ensures your loved one can live a fuller life without compromising their support systems.

#7. You Want More Control Over How And When Assets Are Used

A trust gives you a lot more control than a will on how your assets are used after you’re gone.

You can set rules for how the money is spent.

For example, maybe you want to leave money for your spouse but make sure it’s only used for their healthcare. Or you could decide that your kids only get their inheritance when they reach certain milestones, like graduating college or getting a job.

This level of control isn’t something you can do with a simple will.

A will just says, “Here’s what goes to who.” A trust, however, lets you get much more specific, which can be important if you want to be sure your wishes are followed exactly.

Also Read: Can A Lien Be Placed On An Irrevocable Trust?

#8. You’re Planning For Incapacity

Wills only kick in after you pass away. But what if something happens before that? Like a car accident or medical issue that leaves you unable to make decisions?

A revocable living trust can include language about how to manage your affairs if you become incapacitated.

You pick a trustee (a trusted person or professional) who steps in and handles things for you like paying bills, managing property and keeping things running.

It’s one of those things people often overlook, but it’s a smart move if you want to make sure your affairs are in order, no matter what happens.

#9. You Have A High Net Worth

If your estate is worth a lot (like $5 million or more), taxes can start chipping away at your legacy. Virginia doesn’t have its own estate tax, but federal estate taxes still apply if your estate hits the threshold.

Certain types of trusts like irrevocable life insurance trusts (ILITs) or credit shelter trusts can help reduce the impact of those taxes.

It’s a more advanced strategy, but totally worth exploring if you’ve built up significant wealth and want to protect it for future generations.

Plus, high-value estates often include businesses, investments, and multiple properties.

A trust can keep everything better organized and easier to manage long-term.

Bottom Line

At the end of the day, deciding between a will and a trust comes down to what works best for your situation.

Trusts offer a lot of benefits, from avoiding probate to providing extra control over your assets. Plus it offers more flexibility and peace of mind if you have a complicated family situation, minor children, or significant assets.

So, think about your personal situation. If you’re not sure, talking with an estate planning attorney can help you figure out what’s best for you.